What is meant by a 10-Year Treasury note?

|

T |

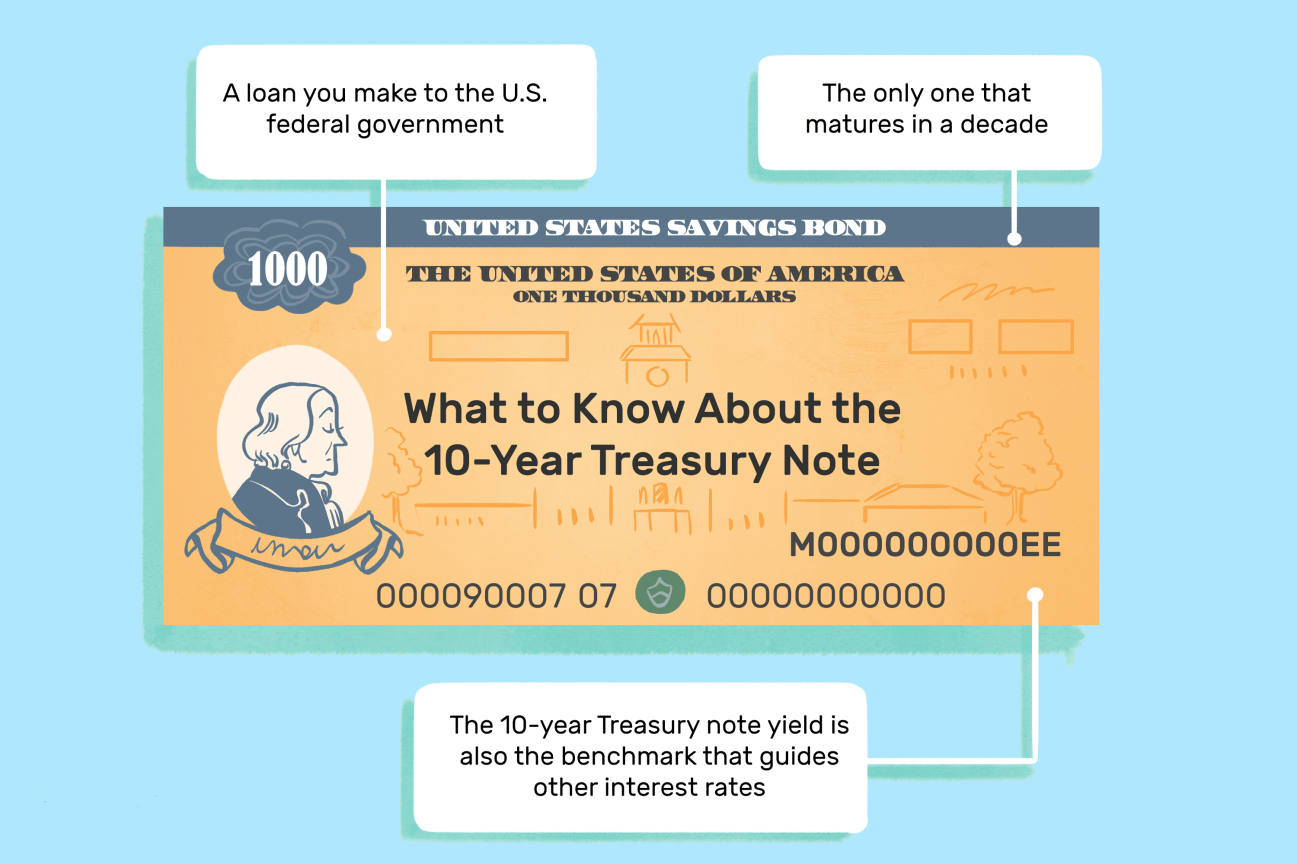

he 10-year Treasury note is an obligation

commitment gave by the United States government with a development of 10 years

upon beginning issuance. A 10-year Treasury note pays revenue at a proper rate

once at regular intervals and pays the presumptive worth to the holder at

development. The U.S. government to some degree subsidizes itself by giving

10-year Treasury notes.

Understanding 10-Year Treasury Notes

The

U.S. government issues 3 unique kinds of obligation protections to financial

backers that are characterized by the length of development, to subsidize its

commitments: Treasury bills, Treasury notes, and Treasury bonds.

Treasury or Depository charges (T-bills) have the most brief developments, with

spans as long as a year. The Treasury offers T-bills with developments of 4, 8,

13, 26, and 52 weeks.

What makes T-bills remarkable in contrast with Treasury notes or Treasury bonds is that they are given at limits to standard and pay no coupon installments. Financial backers are simply paid the assumed worth of the T-bills upon development, actually making them zero-coupon bonds.

Terms and Tracking

Treasury/Depository

notes (T-notes) are presented to 10-year terms, making the 10-year

T-note the one with the longest development. Different lengths of development

for T-notes are two, three, five and seven years. The 10-year T-endlessly notes

of more limited development, pay semiannual coupon installments and are not

zero-coupon obligation instruments. The 10-year T-note is the most broadly

followed government obligation instrument in finance, and its yield is in many

cases utilized as a benchmark for other loan fees, for example, contract rates.

Depository bonds (T-bonds), like T-notes, pay semiannual coupon installments yet

are given regarding 30 years.

The

following is an outline of the 10-year Treasury yield from March 2019 to March

2020. During this one-year time span, the yield consistently declined with

assumptions that the Federal Reserve would keep up with low loan costs and

possibly cut rates further. In late February 2020, the yield started to speed

up its decay as worries about the financial effect of the Covid pandemic

started to pointedly rise. Whenever the Fed went to crisis lengths to cut rates

by 50 premise focuses toward the beginning of March, the decay of the 10-year

yield sped up significantly further, plunging underneath the mentally

significant 1.00% level for another record low. From that point, the yield

dropped right down to a low of 0.36% prior to bouncing back.

The Advantages of Investing in Treasury Notes

A benefit of

putting resources into 10-year Treasury notes and other national government

protections is that the premium installments are absolved from state and

neighborhood personal charges. Be that as it may, they are as yet available at

the government level. The U.S. Depository sells 10-year T-endlessly notes of

more limited developments, as well as T-bills and bonds, straightforwardly

through the Treasury-Direct site by means of cutthroat or noncompetitive

offering, with a base acquisition of $100 and in $100 increases. They can

likewise be bought by implication through a bank or intermediary.

Financial backers

can decide to hold Treasury notes until development or sell them right off the

bat in the optional market. There is no base proprietorship term. Albeit the

Treasury gives new T-notes of more limited developments consistently, the new

10-year T-notes are given exclusively in February, May, August, and November

(the beginning months), with re-openings in the excess months of the year.

Re-openings are 10-year T-notes gave with a similar development dates and loan

costs as protections comparing to the beginning months. All T-notes are given

electronically, meaning financial backers don't hold genuine paper mirroring

the protections, like stocks.